Innovative employee benefits for today’s workforce

Step into the future of employee benefits. PeopleKeep makes offering a stand-out health benefit accessible for all employers—regardless of where they are on their benefits journey.

Start leveraging our health reimbursement arrangement (HRA) platform to offer a benefit that truly resonates with every employee while maintaining control over your budget.

Award-winning software trusted by employers nationwide

Tailored health benefits that work for your entire team

If you want to attract and retain talented employees, you must offer standout benefits as part of your compensation package. At PeopleKeep, we make that possible.

Our innovative HRA software makes offering inclusive health benefits accessible no matter where you are on your benefits journey. It’s designed to give you more control over your benefits budget while catering to the diverse needs of your workforce.

HRA administration software: Compliant, personalized health benefits

An HRA is a formal, IRS-approved health benefit that allows organizations to reimburse their employees, tax-free, for individual health insurance premiums and qualifying out-of-pocket medical expenses. Unlike traditional group health insurance plans—which offer employees limited selection and control— HRAs enable your employees to choose the health coverage that best fits their needs.

PeopleKeep makes launching and managing an HRA accessible and intuitive for employers. We automate time-consuming tasks like preparing and updating legal documentation and reviewing employee reimbursement requests so you can focus on running your business.

PeopleKeep’s software lets you administer three types of HRAs:

Qualified small employer HRA

A powerful alternative to group health insurance made specifically for small employers.

Individual coverage HRA

A health benefit that enables employers to cover the individual insurance plans their employees choose.

Group coverage HRA (integrated HRA)

A health benefit that employers can use to help employees with their out-of-pocket expenses.

Not sure which benefits are the best fit for your business?

Take our easy, interactive benefits quiz.

How our software works

PeopleKeep makes the process of offering a tailor-made health benefit easy. Our user-friendly software allows companies to set up and launch an HRA in minutes. It also gives employers more control over their budget while giving employees more flexibility over how to leverage their benefits.

Here’s a breakdown of how the process works:

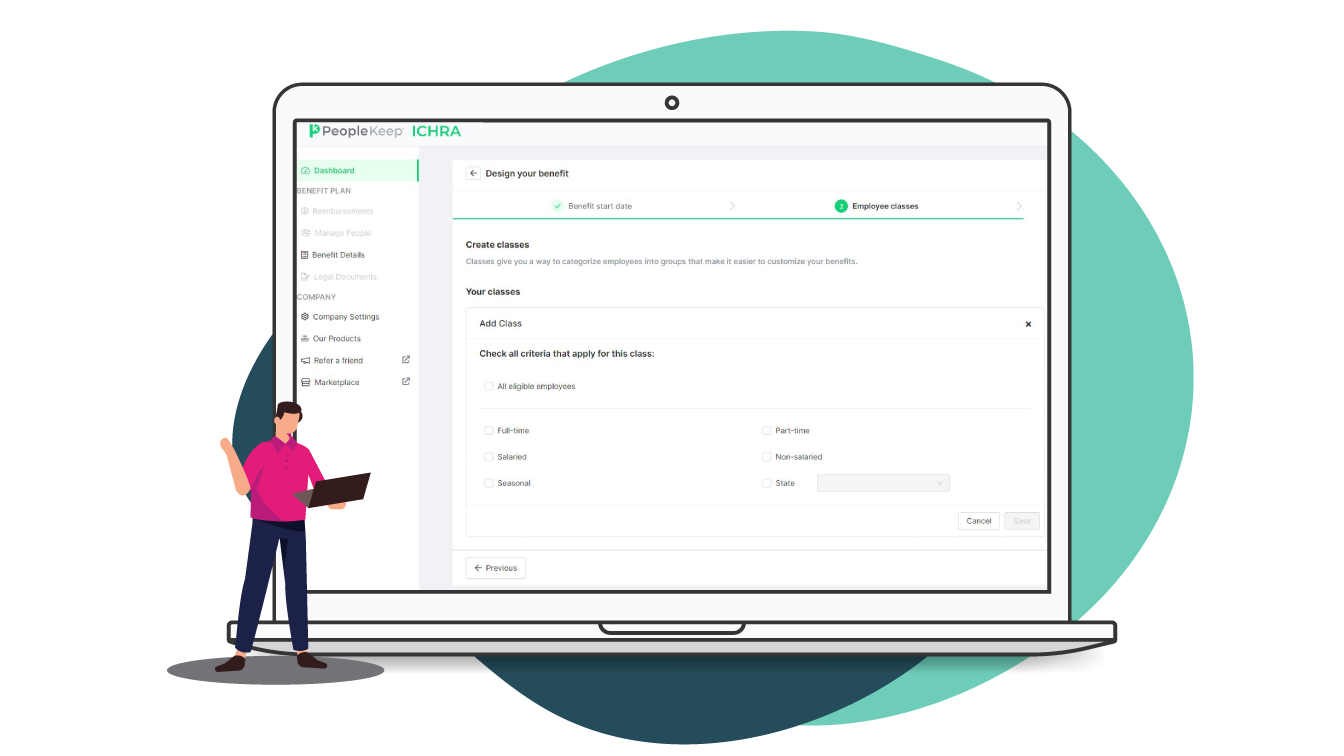

Step 1: Design your benefit & invite employees

Design your custom HRA benefit. Define your benefit start date, allowance amounts, eligibility criteria, and other aspects that align with your company’s policies and employee needs.

Step 2: Employees make eligible purchases

Once invited and onboarded, employees can submit eligible health expenses for reimbursement. Our system ensures a smooth process for submitting and tracking expenses.

Step 3: Approve expenses & reimburse employees

Once submitted expenses are verified and approved, you can proceed with reimbursement. You can reimburse your employees through payroll, check, cash, or bank transfer.Why choose PeopleKeep?

Award-winning support

Our responsive, U.S.-based customer support team is ready to help your team when you need us. We’ve won five consecutive Stevie Awards for our customer service!

Benefit personalization

You have complete control when designing your health benefit. Choose which expenses are eligible for reimbursement, define employee eligibility, and more.

Complete cost-control

Set custom allowance amounts that align with your budget. Say goodbye to unexpected rate hikes and welcome a more sustainable, budget-friendly approach to employee benefits.

What our customers say

“We were sold on PeopleKeep because of your affordable pricing, great customer service... It fits within our budget and the product is clean, robust, and easy to use.”

“PeopleKeep is modern, accurate, compliant, and user-focused. The platform helps keep our records up-to-date. We just log on and it’s all there.”

"Working with PeopleKeep's customer service team through the chat function has been great and responses have been fast."

Learn how some of our customers have leveraged PeopleKeep to build better benefits packages

Discover more

See our software in action

Get a first-hand look at how our platform transforms benefits management. Our downloadable video walkthroughs will show you how PeopleKeep’s software works, as well as its features and benefits.Take our benefits quiz

Not sure which benefits plan is right for you? Let our quiz guide you towards the best options.

Explore our resource library

Dive into our extensive collection of detailed guides, comparison charts, and reports.

Ready to offer a better health benefit without increasing your workload?

Learn how PeopleKeep's HRA platform helps you maximize your employee health benefit without straining your schedule or budget. Schedule a live demo or connect with us to access a personalized quote.